Virginia Solar Tax Credits Could Save You Thousands in 2024

Transform your Virginia home into a clean energy powerhouse while saving thousands through powerful solar incentives available right now. Virginia homeowners can slash their installation costs by up to 30% through the federal Solar Investment Tax Credit (ITC), while net metering programs guarantee substantial returns on your solar investment by crediting you for excess power generated.

Local incentives sweeten the deal further – from property tax exemptions in participating counties to Virginia’s Solar Easements Laws protecting your right to harvest sunshine. Working with an experienced professional to find a qualified solar installer ensures you’ll maximize every available benefit, from PACE financing options to utility-specific rebates that can reduce upfront costs.

Don’t wait – Virginia’s solar incentives are time-sensitive, with some programs operating on a first-come, first-served basis. The combination of falling equipment costs and generous incentives makes 2024 an ideal time to invest in solar power for your home.

Federal Solar Investment Tax Credit (ITC)

How the 30% Federal Tax Credit Works

The federal solar tax credit, also known as the Investment Tax Credit (ITC), allows you to deduct 30% of your total solar installation costs from your federal taxes. This incentive applies to both residential and commercial installations using certified solar equipment.

Here’s how to calculate your credit:

1. Add up all eligible expenses (equipment, installation, and permit costs)

2. Multiply the total by 30%

3. Apply this amount directly to your federal tax liability

For example, if your solar system costs $20,000:

• Total installation cost: $20,000

• Tax credit calculation: $20,000 × 30% = $6,000

• Your tax reduction: $6,000

To claim the credit, file IRS Form 5695 with your annual tax return. If your tax liability is less than your credit amount, you can carry over the remaining credit to the following year. Remember, you must own (not lease) your solar system to qualify, and the installation must be completed within the tax year you’re claiming the credit.

Virginia-Specific Solar Incentives

Property Tax Exemptions

Virginia empowers local governments to offer property tax exemptions for solar installations, making it more affordable for homeowners to invest in renewable energy. Many counties and cities across the state have adopted these exemptions, which typically allow you to exclude the value of your solar system from your property tax assessment for up to 20 years.

To benefit from this incentive, your solar installation must meet local building codes and receive proper permits. The exemption applies to both residential and commercial properties, covering the full value of the solar equipment and installation costs.

Notable localities offering these exemptions include Fairfax County, Arlington County, and the City of Richmond. However, specific terms and coverage vary by jurisdiction. We recommend contacting your local tax assessor’s office to confirm your area’s participation and learn about the application process.

Remember that while your solar installation might increase your property’s market value, these exemptions ensure you won’t pay higher property taxes because of your renewable energy investment.

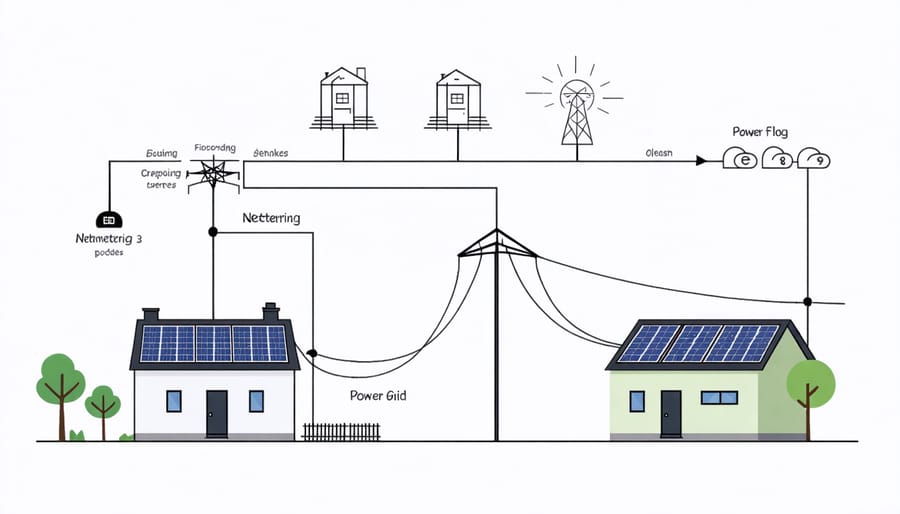

Net Metering Benefits

Net metering is one of the most valuable benefits for Virginia solar homeowners, allowing you to save significantly on your electricity bills. When your solar panels generate more power than you’re using, that excess electricity flows back to the grid, and your utility company credits your account.

In Virginia, these credits appear as dollar-for-dollar reductions on your monthly electric bill. During sunny summer days, you can build up credits when your system produces more than you consume. Then, you can use these credits during cloudy days or at night when your panels aren’t generating power.

Virginia law requires all major utilities to offer net metering to their customers. The maximum system size eligible for net metering is 25 kilowatts for residential customers and 3 megawatts for commercial properties. Any unused credits roll over to your next monthly bill, though they typically expire after 12 months.

To maximize your net metering benefits, consider sizing your solar system to match your annual electricity usage. This approach helps ensure you’re getting the most value from your solar investment while minimizing excess generation that might go unused.

Solar Rights and HOA Rules

Virginia has strong solar rights laws that protect homeowners’ ability to install solar panels. Under the Virginia Property Owners’ Association Act, HOAs cannot prohibit solar installations, though they may place reasonable restrictions on placement and appearance. These restrictions must not increase the system’s cost by more than 5% or reduce its efficiency by more than 10%.

If you live in an HOA community, you’ll need to submit your solar installation plans for approval. While HOAs must process these requests within 60 days, it’s best to start this process early in your solar journey. Most associations have specific guidelines about panel placement, visibility from streets, and aesthetic requirements.

Remember that HOAs can’t enforce blanket solar prohibitions, even if they’re written into existing covenants. If you encounter resistance, you can reference Virginia Code § 67-701, which explicitly protects your solar rights. Many Virginia homeowners have successfully installed solar systems while maintaining good relationships with their HOAs by following proper procedures and communicating openly about their plans.

Local Utility Rebates and Programs

Dominion Energy Solar Programs

Dominion Energy offers several solar programs to help Virginia residents transition to renewable energy. Their Solar Purchase Program provides customers with the opportunity to sell excess solar power back to the grid through net metering arrangements. Homeowners can receive credit on their monthly bills for the surplus energy their systems generate.

The utility also runs the Non-Residential Solar Program, which supports businesses and organizations installing solar panels. Through this initiative, qualifying customers can receive performance-based incentives for their solar generation.

For income-qualified households, Dominion Energy’s Solar Affordability Program helps make solar more accessible by providing additional financial support and resources. This program includes free energy assessments and enhanced incentives to help offset installation costs.

To participate in any of these programs, customers must work with certified solar contractors and ensure their systems meet Dominion Energy’s interconnection requirements. The application process is straightforward, and Dominion’s solar specialists are available to guide customers through each step of enrollment.

Other Utility Company Offerings

Beyond Dominion Energy, several Virginia utility companies offer attractive solar incentives for their customers. Appalachian Power provides a net metering program that credits customers for excess energy production at retail rates. The Rappahannock Electric Cooperative offers special solar-friendly rate structures and assistance with interconnection processes.

Shenandoah Valley Electric Cooperative members can benefit from their Smart Grid program, which includes solar integration support and energy monitoring tools. Northern Virginia Electric Cooperative (NOVEC) provides educational resources and technical assistance for solar installations, along with flexible payment options for grid interconnection fees.

Many municipal utilities across Virginia also offer their own incentive programs. For example, the City of Manassas Utilities offers rebates for solar installations, while Harrisonburg Electric Commission provides specialized rates for solar customers. Contact your local utility provider directly to learn about specific programs available in your area, as offerings and terms may vary by location.

Financing Options for Solar Installation

Solar Loans and PACE Financing

Virginia residents have several financing options to help make solar installation more affordable. Many local banks and credit unions offer specialized solar loans with competitive interest rates and flexible terms. These loans typically feature lower monthly payments than traditional home improvement loans and can be structured to ensure your energy savings offset the loan payments.

Property Assessed Clean Energy (PACE) financing is another option that’s gaining traction in Virginia. While residential PACE programs are still developing, commercial PACE financing is available in several Virginia jurisdictions. This innovative financing method allows property owners to fund solar installations through an assessment added to their property tax bill, spreading the cost over an extended period.

Several solar installers in Virginia also partner with financing companies to offer in-house loans or lease options. These often come with $0 down payment options and include maintenance coverage. Some popular choices include same-as-cash loans, which allow you to pay off the system within 12-18 months without interest, and solar leases that enable you to go solar with minimal upfront costs.

Before choosing a financing option, compare multiple offers and carefully review terms, interest rates, and fees to find the best fit for your situation.

Solar Leases and PPAs

For Virginia homeowners who prefer not to purchase solar panels outright, solar leases and Power Purchase Agreements (PPAs) offer attractive alternatives. These financing options allow you to go solar with little to no upfront costs while still enjoying reduced electricity bills.

With a solar lease, you’ll pay a fixed monthly amount to use the solar panel system, similar to leasing a car. The leasing company owns, maintains, and insures the equipment, making this option hassle-free for homeowners. Your monthly lease payment is typically lower than your current electricity bill, resulting in immediate savings.

PPAs work slightly differently – instead of paying for the equipment, you only pay for the power the panels produce, usually at a rate lower than your utility company’s. This arrangement often includes maintenance and monitoring services, ensuring optimal system performance throughout the agreement term.

Both options typically run for 20-25 years, with opportunities to purchase the system, renew the agreement, or have the equipment removed at the end of the term. While these arrangements may offer lower long-term savings compared to purchasing, they provide an accessible path to clean energy for many Virginia residents.

Taking advantage of Virginia’s solar incentives has never been more accessible or financially rewarding. By combining federal tax credits, state-level benefits, and local utility rebates, Virginia homeowners can significantly reduce their initial solar installation costs while investing in a cleaner energy future.

To get started on your solar journey, begin by getting multiple quotes from certified solar installers in Virginia. Take time to review your electricity usage patterns and ensure your home is solar-ready. Remember that the 30% federal tax credit, net metering programs, and property tax exemptions are powerful tools that can make your solar investment more affordable.

Don’t forget to check with your local utility company about specific programs they offer, as these can vary by region. Many Virginia homeowners are already saving thousands annually on their energy bills while increasing their property values through solar installation.

Ready to make the switch? Consider scheduling a solar assessment to determine your home’s potential for solar energy. With proper planning and by leveraging available incentives, you can join the growing community of Virginia homeowners embracing sustainable energy while enjoying significant long-term savings.